Digital Transitions, Hardware, Lenses, Lighting, Phase One, Promotions, Software

Section 179 Tax Savings When You Buy Now

SECTION 179 TAX SAVINGS WHEN YOU BUY NOW

Section 179 of the US Tax Code allows small businesses to deduct the full purchase price of equipment in that tax year (even if they’re leasing it), up to $1,080,000, instead of spreading the depreciation of the purchase over multiple years. This means that if you buy a new camera system or photo gear, you can deduct it from your taxable income immediately, saving you from paying additional, unnecessary income tax. This makes purchasing equipment for your business a strategic benefit, and now is the best time to upgrade or add to your photo studio.

SEE HOW MUCH YOU CAN SAVE SECTION 179 TAX DEDUCTIONS

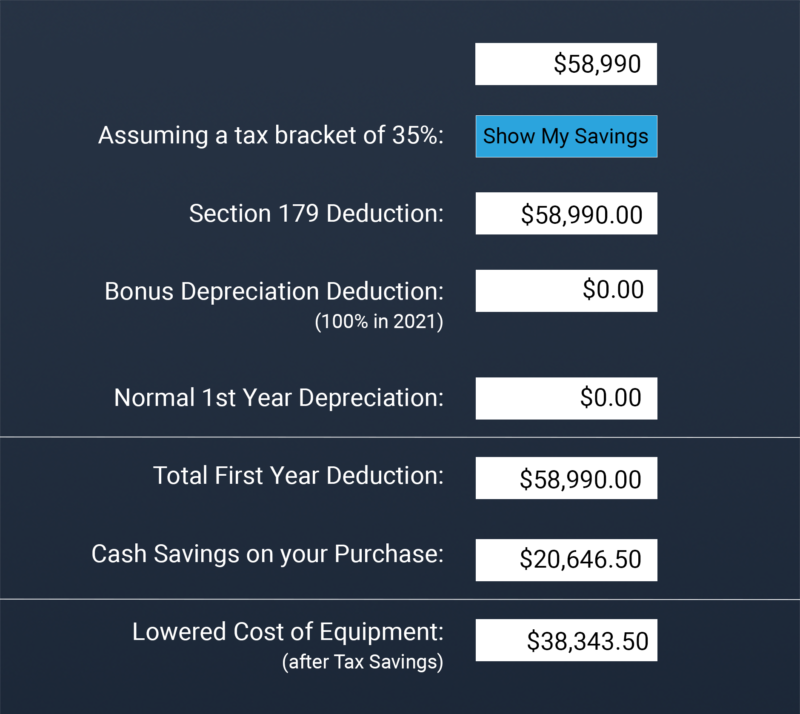

The graph to the right shows a realistic breakdown of the savings you could receive by purchasing before the end of the year!

For an idea of what that can save you in taxes, use this convenient Section 179 Deduction Calculator, or reach out to our expert staff by filling out the form below!

Read more about what you can save on your taxes here or fill out the form below to get in touch with your regional representative for guidance on your purchase.

THE DIGITAL TRANSITIONS E-SHOP IS OPEN 24/7, CLICK HERE TO SHOP NOW!

For assistance with your purchase or more information on how to get the best year-end savings on Phase One medium format equipment, fill out the form below and one of our experts will be in touch.